42 deferred revenue asset or liability

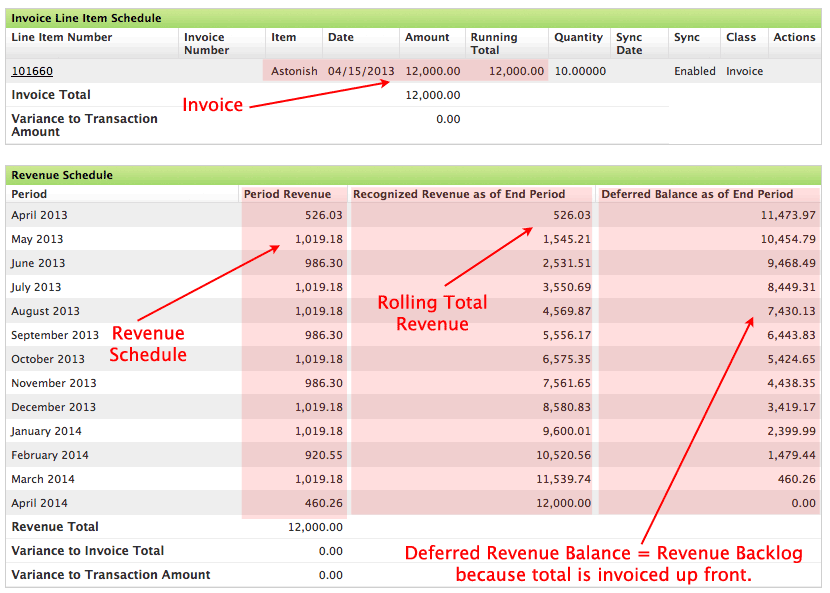

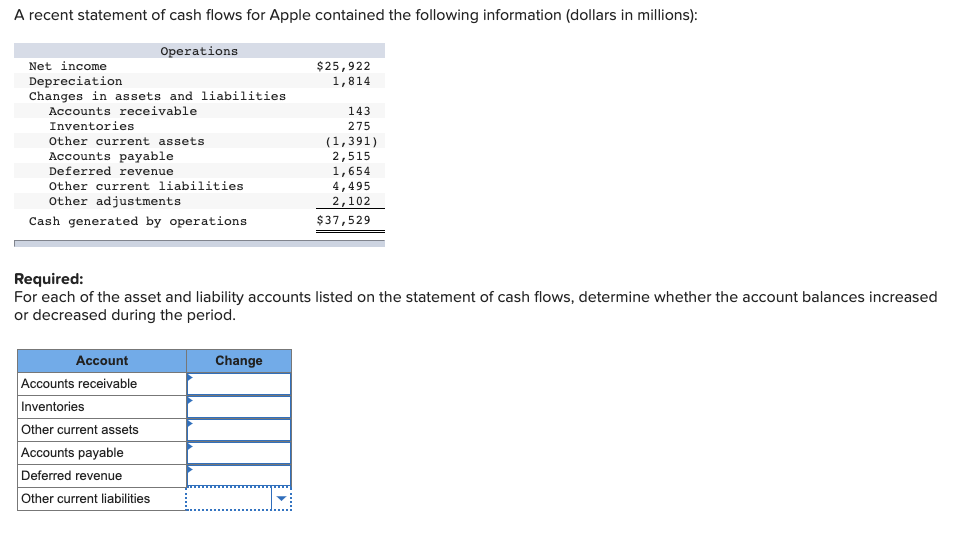

Deferred Revenue Expenditure: Meaning and Examples Deferred Revenue Expenditure Capital expenditure leads to the purchase of an asset or which increases the earning capacity of the business. The organization derives benefit from such expenditure for a long-term. For example, the purchase of building, plant and machinery, furniture, copyrights, etc. Deferred Revenue vs. Revenue Backlog - SaaSOptics Deferred Revenue vs. Revenue Backlog Deferred Revenue Deferred Revenue is a current liability account used in financial reporting. Deferred Revenue appears on the balance sheet and is calculated as follows: The sum of (the total of Invoices for all Contract Elements for a single Contract minus the total of Recognizable Revenue for all Contract ...

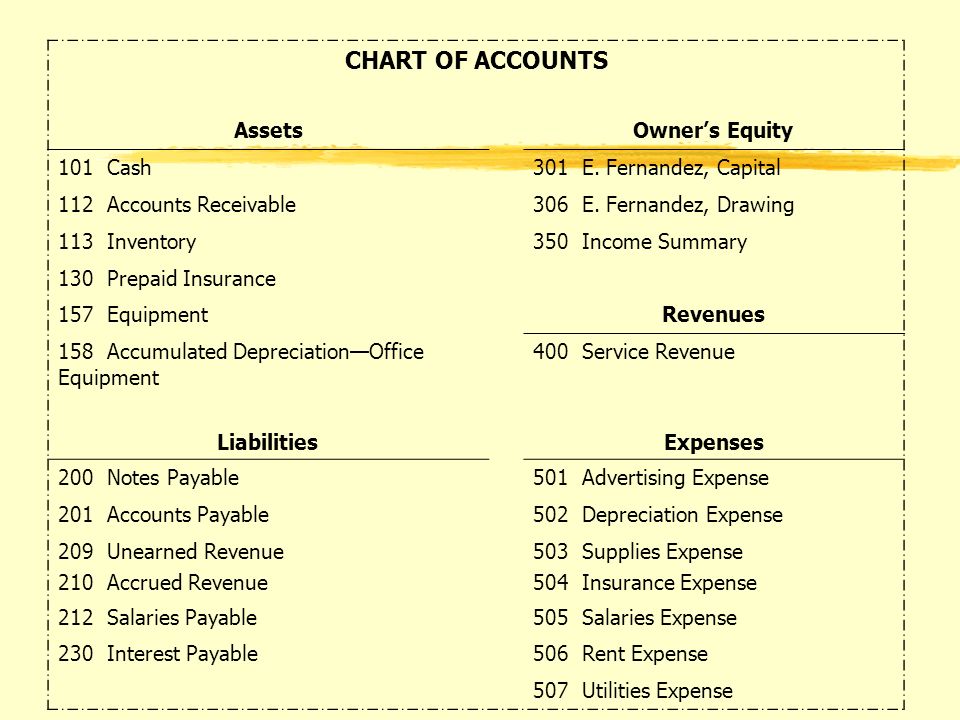

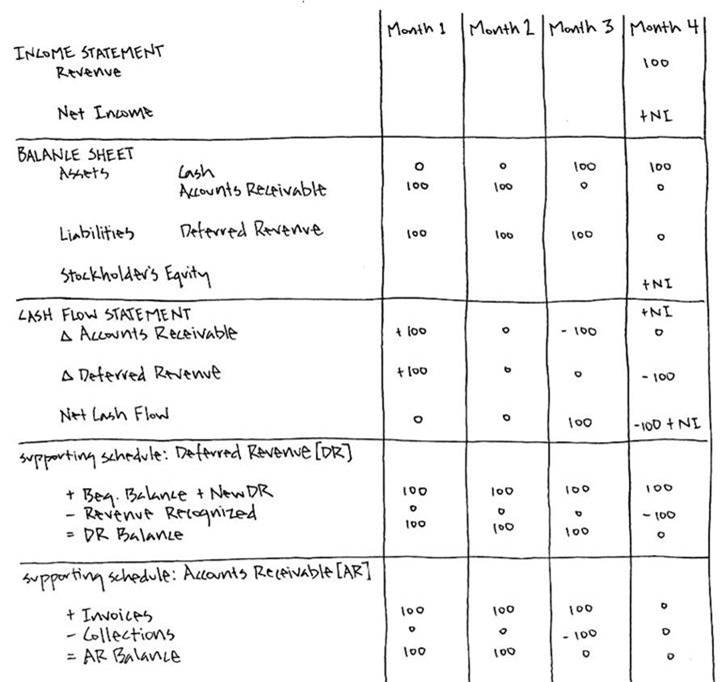

› sales › deferredDeferred Revenue Journal Entry - Double Entry Bookkeeping Aug 09, 2019 · In this case one asset (accounts receivable) increases representing money owed by the customer, this increase is balanced by the increase in liabilities (deferred revenue account). The credit to the deferred revenue account represents a liability as the service still needs to be provided to the customer. Deferred Revenue Recognition. Deferred ...

Deferred revenue asset or liability

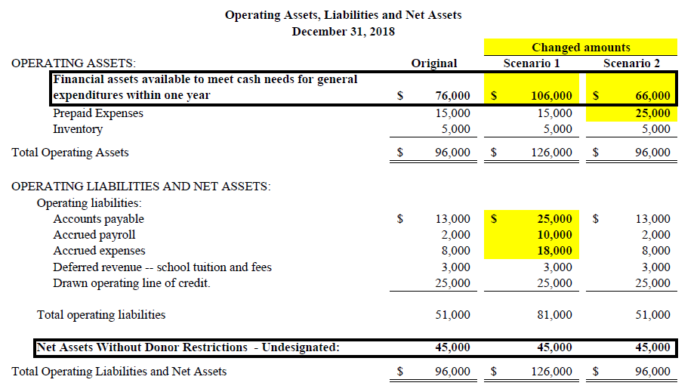

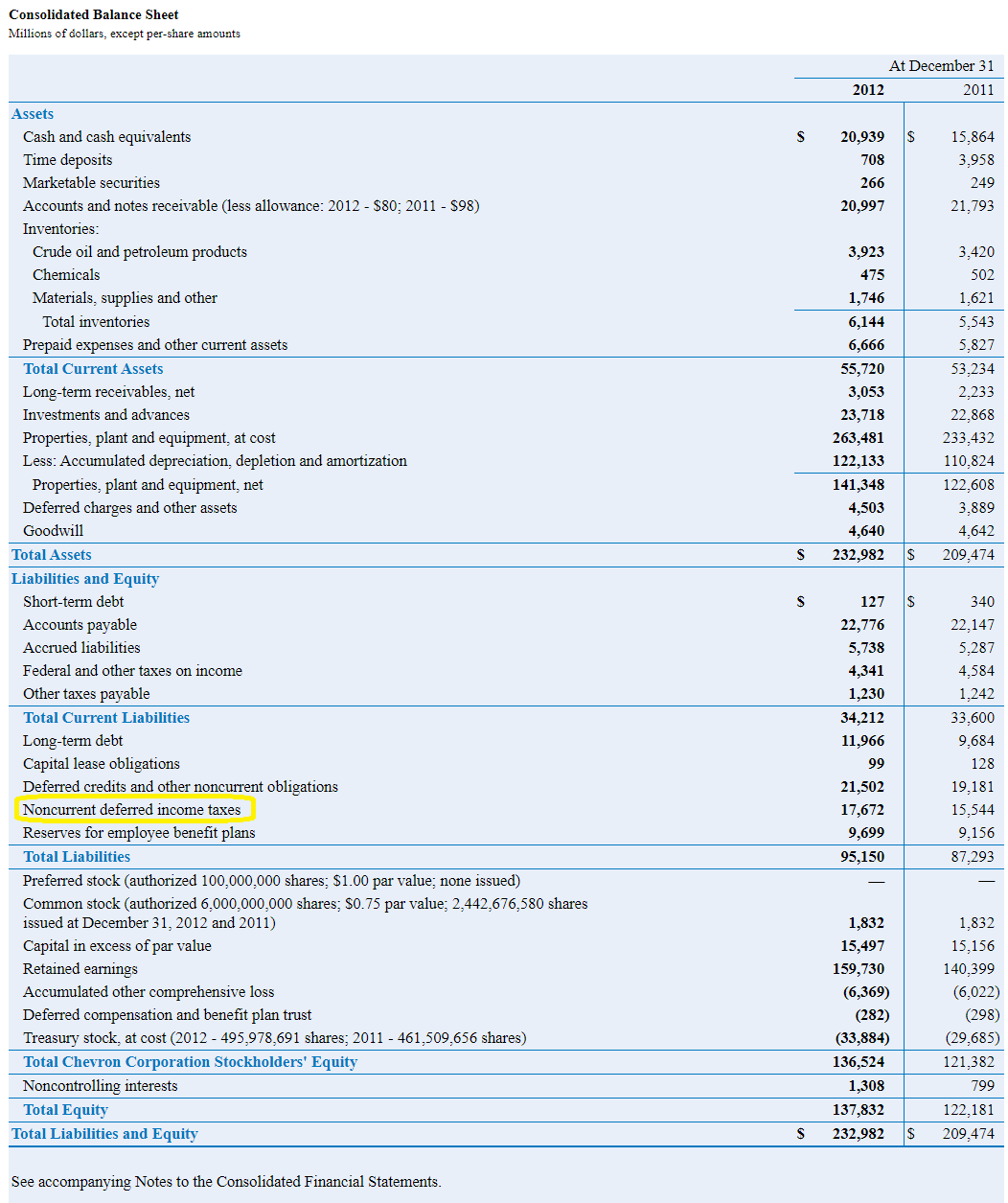

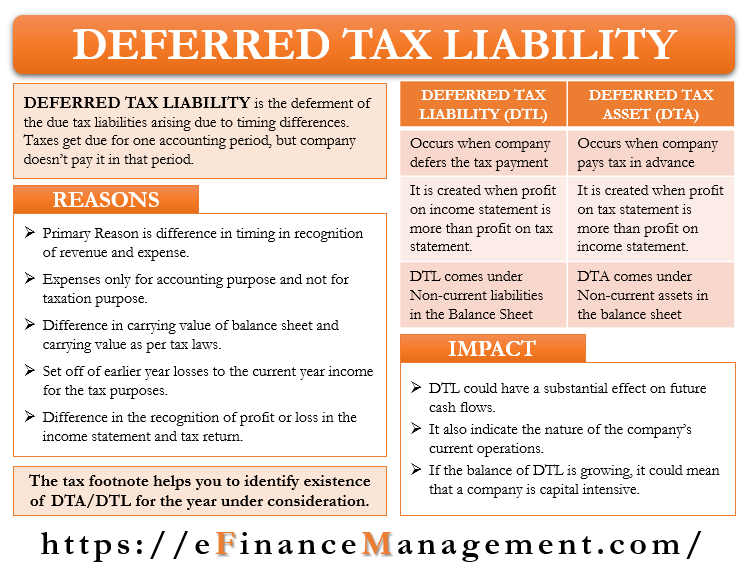

What are Deferred Tax Assets and Liabilities? Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations. Is Deferred income a current liability? - AskingLot.com Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability. Is Service Revenue Asset or Liability + How to Calculate It When this occurs, it's typically recorded as a credit to the income statement and an asset account called deferred expenses. On the other hand, when these types of revenues are billed after work has been completed, they are usually recorded as a debit to the income statement. Is service revenue on a balance Sheet? Absolutely.

Deferred revenue asset or liability. Is Deferred rent an asset? - FindAnyAnswer.com Deferred rent is defined as the liability that is created as a result of the difference between the actual cash paid and the straight-line expense recorded on the financial statements. Also Know, is Deferred rent a current or long term liability? › recur › allWhat is deferred revenue? Is it a liability & accounting for it Is deferred revenue a debit or credit in accounting? Since deferred revenue is a liability until you deliver the products or services per the booking agreement, you will make an initial credit entry on the right side of the balance sheet under current liability (if the sale is under 12 months) or long-term liability. › how-to-calculate-deferredHow to calculate Deferred Tax Asset / Liability AS-22 Nov 21, 2016 · So deferred tax asset is created, which is adjusted with the deferred tax liability of last year. The balance of Rs. 291,000 will be charged back in profit and loss account under tax expenses and Rs. 3,09,000 will be shown as deferred tax asset under non-current assets. Method 2: By Computing differences in WDV as per IT and companies act. Is Deferred rent a liability? Deferred rent is the balance sheet account that was used under ASC 840 to enable straight-line rent expense. The lease liability of any lease set up under ASC 842 is based on the NPV of future payments. The ROU asset is initially based on that same value, but adjustments are sometimes required.

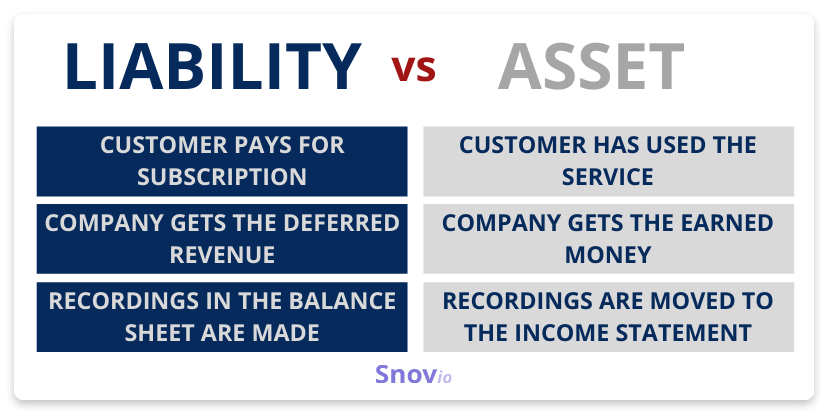

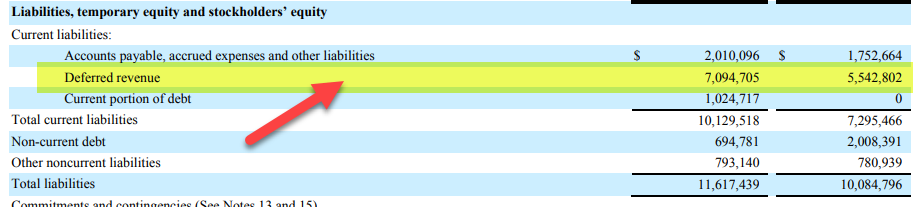

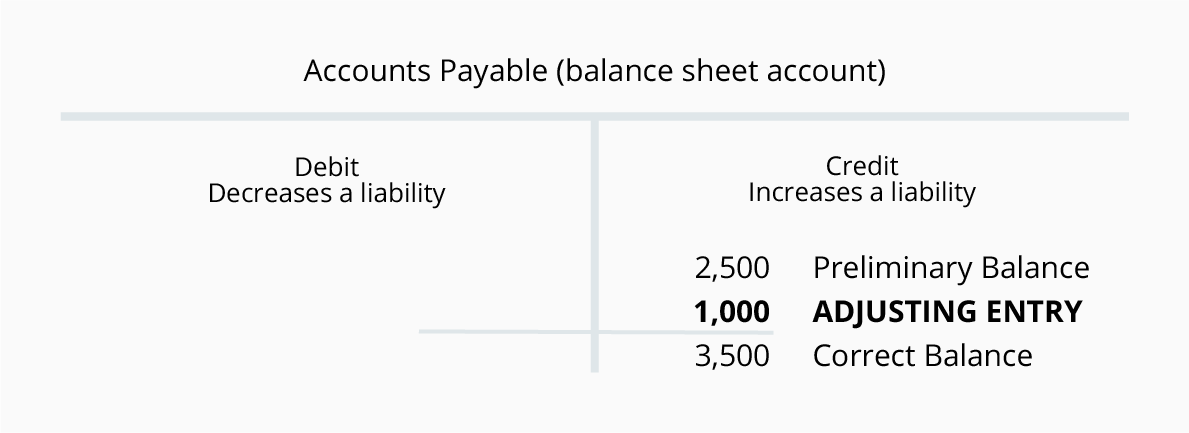

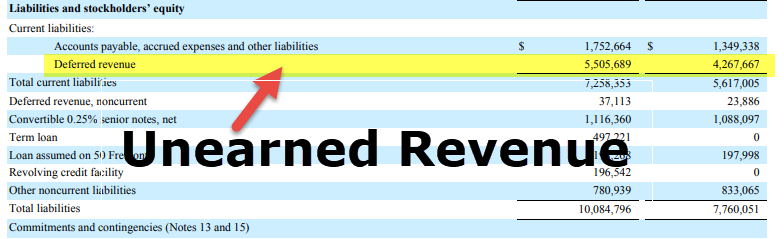

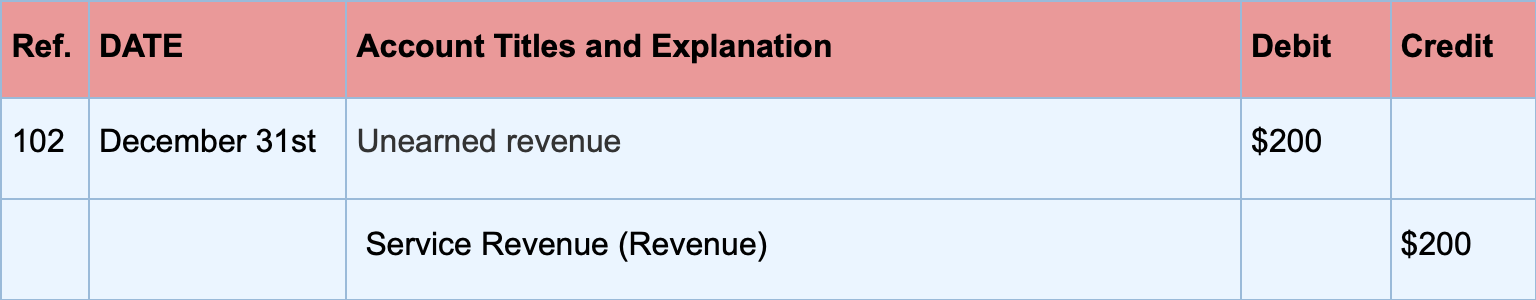

Is Deferred Revenue a Liability? - Baremetrics Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services. Revenue Recognition - Contract Assets & Contract ... Commonly referred to as deferred revenue or unearned revenue. A contract liability is an entity's obligation to transfer goods or services to a customer for which the entity has received consideration from the customer (or the payment is due, see Example 2) but the transfer has not yet been completed. Deferred Revenue, Basic Accounting Transactions, Financial ... Deferred revenue refers to an item that will initially be recorded as a liability, but is expected to become an asset over time and/or through the normal operations of the business. Deferred revenue is sometimes called unearned revenue, and it is through the use of this term that I believe it makes it easier to understand why it is initially a liability but is later transferred to an asset item. What Is The Difference Between Deferred Revenue And ... Revenue recognition standard offers advice on booking liabilities and breakage income for unredeemed gift cards. The initial accounting journal entry for a prepayment is a debit to the Cash in Bank asset account and a credit to the Deferred Unearned Revenue liability account.

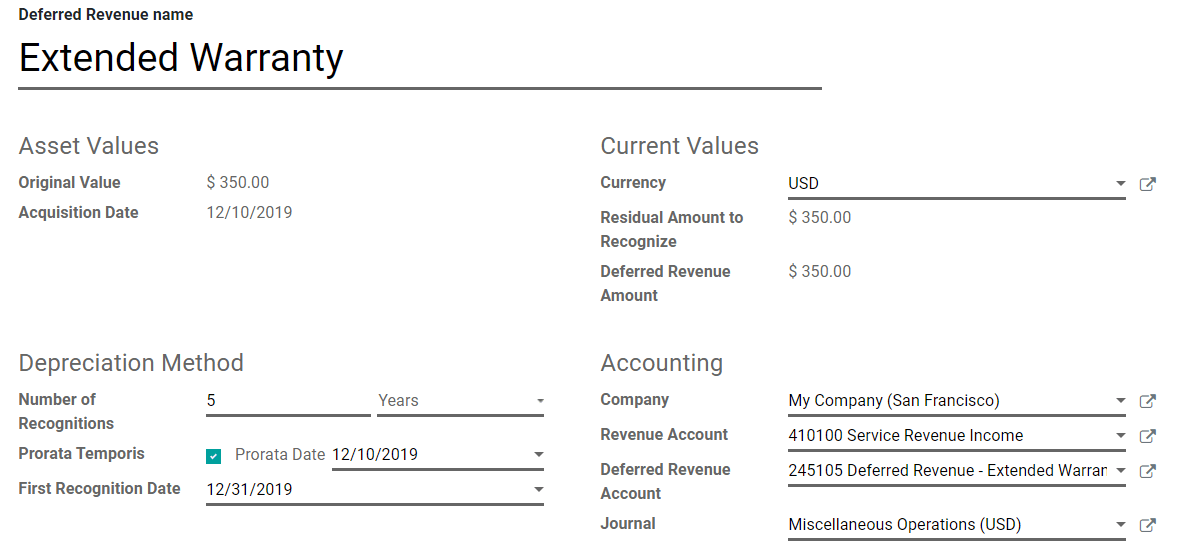

› knowledge-center › the-differenceWhat Is the Difference Between Deferred Revenue and Unearned ... Nov 28, 2018 · Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. Service providers are another example of businesses that typically deal with deferred revenue. Deferred Revenue (Definition)| Accounting for Deferred Income Deferred revenue is the amount of income earned by the company for the goods sold or the services, however, the product or service delivery is still pending and examples include like advance premium received by the insurance companies for prepaid insurance policies, etc. Thus, the Company reports it as a deferred revenue a liability than an asset ... Accounting 101: Deferred Revenue and Expenses - Anders CPA Accounting for Deferred Revenue. Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. Instead they are reported on the balance sheet as a liability. As the income is earned, the liability is decreased and recognized as income. Here is an example for a $1,000 payment for ... Is Deferred revenue a contract liability? Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability. Additionally, what is an example of a deferred revenue?

Temporary Difference | Explanation | Types | Examples ... And as deferred revenue is a liability, the temporary difference, in this case, is the deductible temporary difference. Example of temporary difference for depreciation For example, in Jan 2019, ABC Co. bought a truck that cost $20,000 to use in the company.

snov.io › glossary › deferred-revenueWhat is Deferred Revenue: Definition, examples, importance ... May 05, 2021 · Is deferred revenue a liability? Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer. Deferred revenue examples. All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples: Advance rent; Mobile service ...

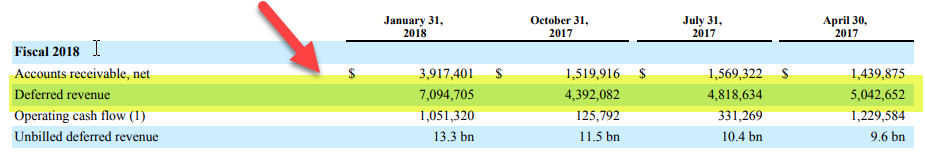

saascfoservices.com › what-are-deferred-revenueWhat are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Aug 25, 2020 · Deferred Revenue is a liability on the Balance Sheet. It represents a future obligation. Performance of this obligation leads to recognition of revenue and the reduction of the liability. Most SaaS companies send invoices in advance of providing their service (e.g., you invoice for an entire year). Thus, most SaaS companies will have Deferred ...

Deferred Tax Liability (or Asset) - How It's Created in ... How is a Deferred Tax Liability or Asset Created? A deferred tax liability or asset is created when there are temporary differences Permanent/Temporary Differences in Tax Accounting Permanent differences are created when there's a discrepancy between pre-tax book income and taxable income under tax returns and tax between book tax and actual income tax.

Deferred Revenue - Understand Deferred Revenues in Accounting On the balance sheet, cash would be unaffected, and the deferred revenue liability would be reduced by $100. The pattern of recognizing $100 in revenue would repeat each month until the end of 12 months, when total revenue recognized over the period is $1,200, retained earnings are $1,200, and cash is $1,200.

What is Deferred Liability? (with picture) - wiseGEEK Deferred liability refers to a debt which is incurred and due which a person or entity does not resolve with a payment. The payment will be due at some point in the future and thus the liability is said to be "deferred." A number of types of liabilities can be deferred, ranging from payments on loans to income taxes which must be paid.

Why is accrued revenue (unlike deferred revenue) an asset ... Deferred revenue is like accounts payable; you are given something without giving something back in exchange. You have a liability on your hands until you give the other party what you owe them. In the case of deferred revenue for rent for example, you receive money, but you have not given the other party the service of rent.

Accounting Basics: Assets, Liabilities, Equity, Revenue ... Because of their higher costs and longevity, assets are not expensed, but depreciated, or "written off" over a number of years according to one of several depreciation schedules. Liabilities Liabilities are the debts, or financial obligations of a business - the money the business owes to others. Liabilities are classified as current or long-term.

› Account-For-Deferred-RevenueHow to Account For Deferred Revenue: 6 Steps (with Pictures) Mar 04, 2021 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). X Research source In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription.

Deferred Revenue Definition - Investopedia Deferred revenue is a liability because it reflects revenue that has not been earned and represents products or services that are owed to a customer. As the product or service is delivered over...

Explained - Deferred Tax Asset vs. Deferred Tax Liability What is Deferred Income Tax Asset and Liability? Deferred Tax Asset (DTA) or Deferred Taxes Liability (DTA) plays a huge role in financial statements. This adjustment is made while closing the Books of Accounts at the end of the year and it affects the outgoing income tax for the business for the financial year and in the future.

What is deferred revenue? | AccountingCoach Deferred Revenue. Deferred revenue is money received by a company in advance of having earned it. In other words, deferred revenues are not yet revenues and therefore cannot yet be reported on the income statement. As a result, the unearned amount must be deferred to the company's balance sheet where it will be reported as a liability.

Why is Deferred Revenue Treated as a Liability? Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been...

Is deferred revenue a liability? - Accounting Capital The concept of deferred revenue applies only if an entity follows the Accrual System of Accounting. If the entity follows the cash system of accounting it's of no relevance as the entire amount received becomes income in the year of receipt. Whether the Deferred Revenue is a Liability? The answer to this question is "Yes" it is a liability.

Is Deferred income an asset? - AskingLot.com Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company's balance sheet as a liability and not as an asset. Click to see full answer. Also asked, what is deferred income on balance sheet?

Is Service Revenue Asset or Liability + How to Calculate It When this occurs, it's typically recorded as a credit to the income statement and an asset account called deferred expenses. On the other hand, when these types of revenues are billed after work has been completed, they are usually recorded as a debit to the income statement. Is service revenue on a balance Sheet? Absolutely.

Is Deferred income a current liability? - AskingLot.com Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability.

What are Deferred Tax Assets and Liabilities? Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

![Solved] Presented below are the 2021 income statement and ...](https://www.solutioninn.com/images/question_images/1568/8/9/3/9495d836bfd670371568877237224.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

0 Response to "42 deferred revenue asset or liability"

Post a Comment