43 generally accepted accounting principles

financial statements under existing generally accepted ... financial statements under existing generally accepted accounting principles (GAAP). The tax benefits of both are reported as a credit to shareholders' equity. e. Dividends that are paid on unallocated shares held by an employee stock ownership plan and that are charged to retained earnings. This is different from a tax deduction received for the payment of dividends on allocated shares held ... Generally Accepted Accounting Principles (GAAP) Definition What Are Generally Accepted Accounting Principles (GAAP)? Generally accepted accounting principles (GAAP) refer to a common set of accounting principles, standards, and procedures issued by the...

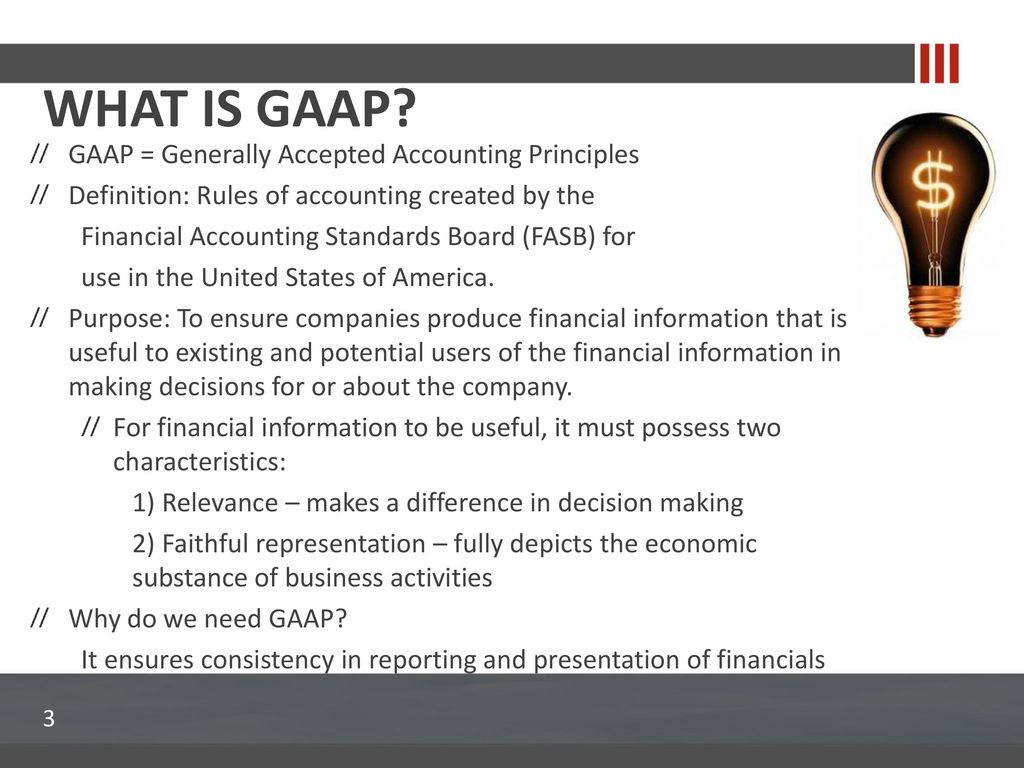

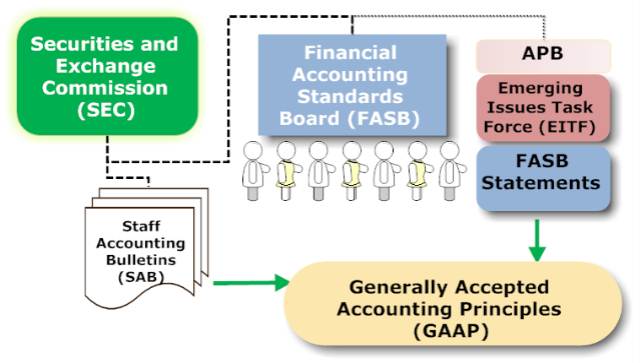

What Are the Generally Accepted Accounting Principles? Accounting The Generally Accepted Accounting Principles (GAAP) are a set of rules, guidelines and principles companies of all sizes and across industries in the U.S. adhere to. In the U.S., it has been established by the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA).

Generally accepted accounting principles

What are Generally Accepted Accounting Principles (GAAP ... That's where Generally Accepted Accounting Principles (GAAP) come in. GAAP represents methods, rules and practices that provide guidelines and procedures—as well as objective standards—for financial data and statements. In short: GAAP standardizes accounting for all companies, so the data they're reporting is universally understood and ... Generally Accepted Accounting Principles Research Papers ... Accounting Finance, Generally Accepted Accounting Principles Strategic design of robust global supply chains: two case studies from the paper industry To remain competitive in today's competitive global economy, corporations must constantly improve their global logistics strategy, modify their supply chain configuration, and update ... PDF The Hierarchy of Generally Accepted Accounting Principles ... 1. The objective of this Statement is to identify the sources of accounting principles and the framework for selecting the principles used in the preparation of general purpose financial reports of federal reporting entities3 that are presented in conformity with generally accepted accounting principles (the GAAP hierarchy). a.

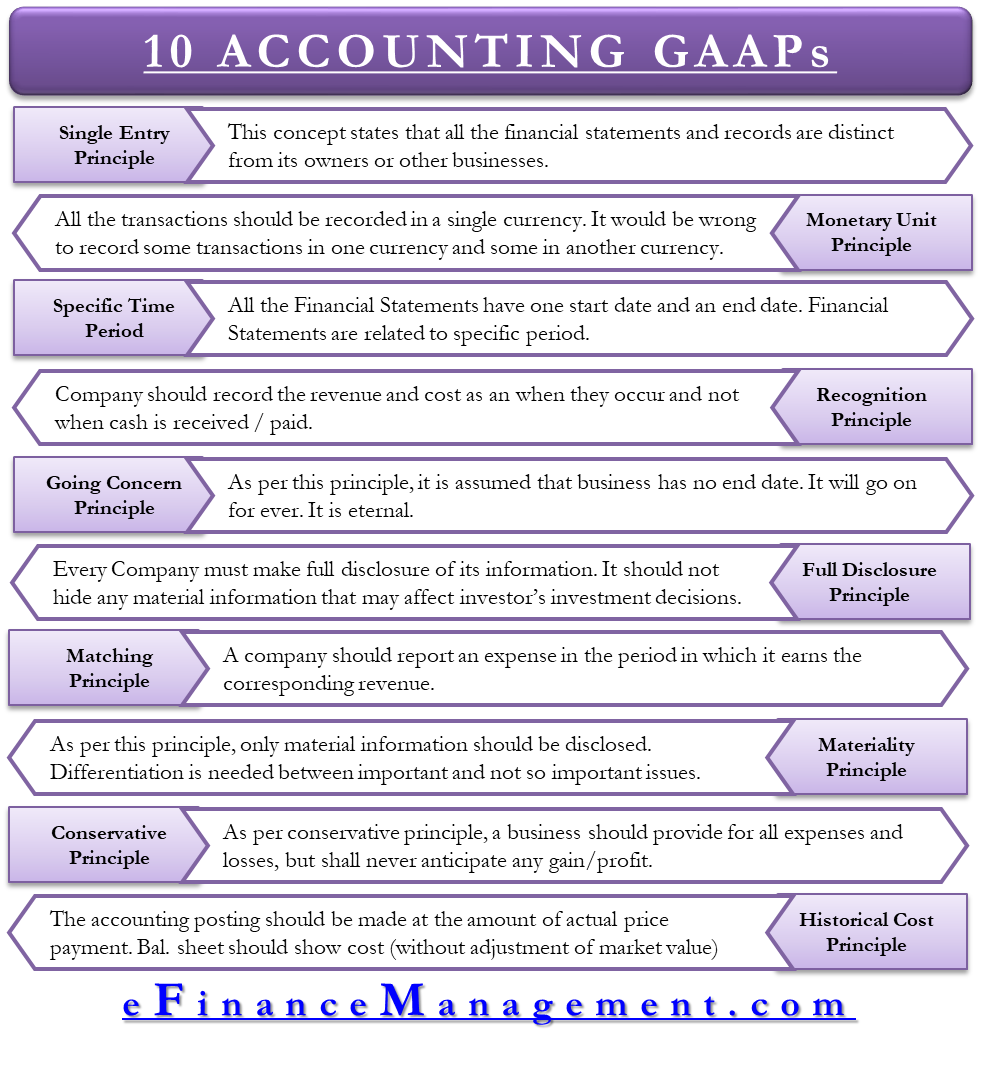

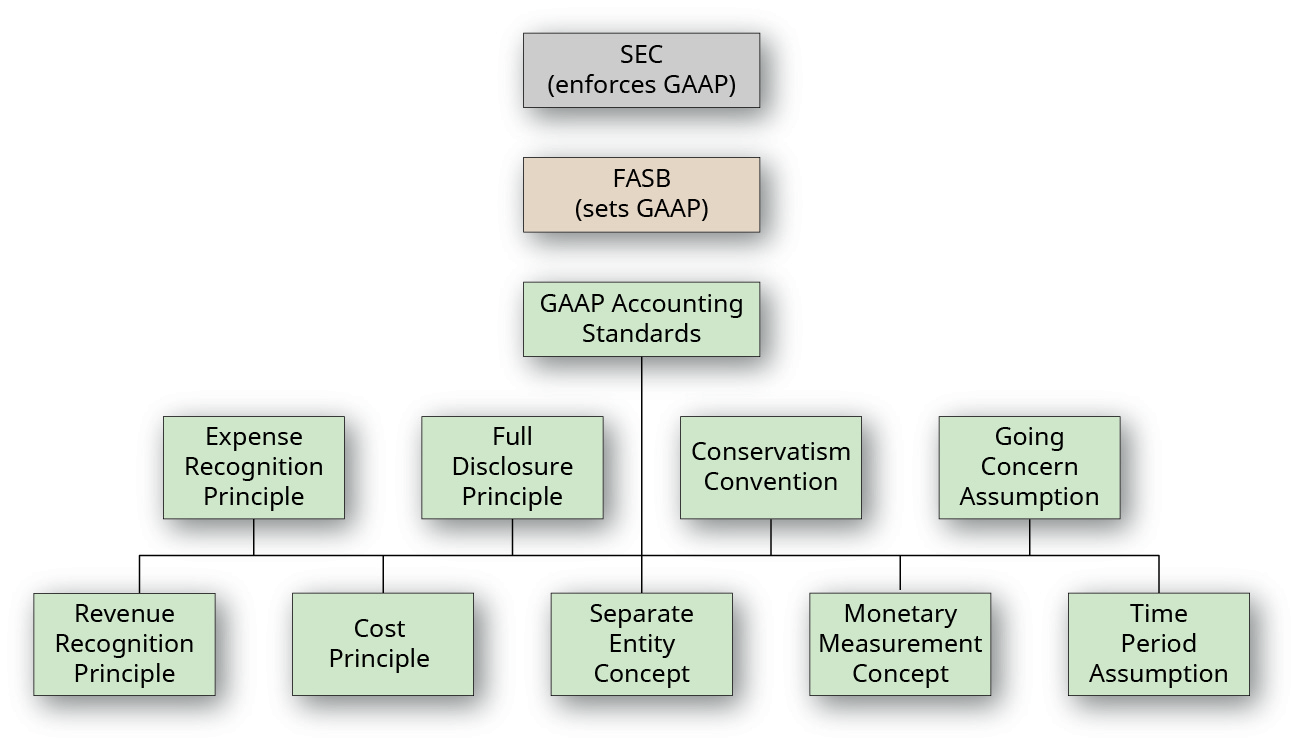

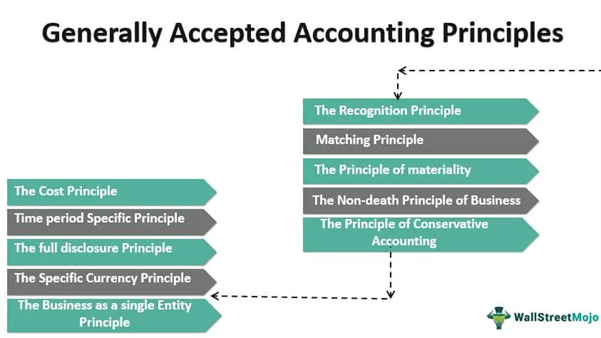

Generally accepted accounting principles. Generally Accepted Accounting Principles Generally Accepted Accounting Principles Accountants use generally accepted accounting principles (GAAP) to guide them in recording and reporting financial information. GAAP comprises a broad set of principles that have been developed by the accounting profession and the Securities and Exchange Commission (SEC). Standards - FASB Accounting Standards Codification On July 1, 2009, the FASB Accounting Standards CodificationTM became the single official source of authoritative, nongovernmental U.S. generally accepted accounting principles (GAAP). Learn about the Codification and how to use it here. >> More Private Company Decision-Making Framework GAAP: Generally Accepted Accounting Principles Definition The Generally Accepted Accounting Principles (GAAP) consist of the sum of all decisions and opinions made by CAP, APB, and FASB over the years. The 10 Generally Accepted Accounting Principles. When referring to the GAAP accounting standards, there are 10 principles that guide companies in preparing financial statements: #1: Regularity What Is Generally Accepted Accounting Principles Gaap And ... A system known as the Generally Accepted Accounting Principles defines four basic assumptions, four basic principles and four basic constraints to business accounting. The four basic principles of GAAP deal with the way that money flows into and out of the business as well as the way that this flow is documented.

Generally Accepted Accounting Principles (GAAP ... Generally accepted accounting principles, or GAAP, are standards that encompass the details, complexities, and legalities of business and corporate accounting. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. Explore the Main Points What Are Generally Accepted Accounting Principles ... What are the 10 generally accepted accounting principles? The 10 generally accepted accounting principles include economic entity, monetary unit assumption, cost principle, revenue recognition, matching principle, conservatism principle, time period principle, going concern principle, materiality principle, and full disclosure principle. Standards & Guidance - fasab.gov Standards & Guidance - fasab.gov Standards & Guidance The FASAB Handbook of Accounting Standards and Other Pronouncements, as Amended (Current Handbook) —an approximate 2,500-page PDF—is the most up-to-date, authoritative source of generally accepted accounting principles (GAAP) developed for federal entities. Wiley Not For Profit Gaap 2018 Interpretation And ... Mar 22, 2021 · Generally Accepted Accounting Principles or GAAP are the set of accounting principles, concepts, and guidelines that guide the more detailed and comprehensive accounting rules, practices, and standards. There are ten major GAAP principles that have evolved over decades and serve as the foundation of accounting.

GAAP: What Is It? - The Balance Generally Accepted Accounting Principles, or GAAP, are accounting standards used by public companies and other organizations in the U.S. to report their financial results. Investors rely on them to make sound investment decisions. Learn the purpose and history of GAAP and its alternatives to become a more informed investor. GAAP: What Are 'Generally Accepted Accounting Principles ... Generally accepted accounting principles — or GAAP (pronounced "gap") for short — are a group of accounting standards that are used to prepare financial statements for companies, not-for-profit... › m › managerialaccountingManagerial Accounting Definition Oct 08, 2021 · Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to complete their financial statements in ... What are generally accepted accounting principles (GAAP ... Definition of Generally Accepted Accounting Principles Generally accepted accounting principles (commonly referred to as GAAP or US GAAP) are the common accounting rules that must be followed when a U.S. company prepares financial statements that will be distributed to people outside of the company.

What is GAAP? - AccountingTools GAAP is short for Generally Accepted Accounting Principles. GAAP is a cluster of accounting standards and common industry usage that have been developed over many years. It is used by organizations to: Properly organize their financial information into accounting records; Summarize the accounting records into financial statements; and.

GAAP: Generally Accepted Accounting Principles | CFI Generally Accepted Accounting Principles were eventually established primarily as a response to the Stock Market Crash of 1929 and the subsequent Great Depression, which were believed to be at least partially caused by less than forthright financial reporting practices by some publicly-traded companies.

Generally Accepted Accounting Principles (United States ... Generally Accepted Accounting Principles ( GAAP or U.S. GAAP, pronounced like "gap") is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC).

About GAAP - Accounting Foundation The standards are known collectively as Generally Accepted Accounting Principles—or GAAP. For all organizations, GAAP is based on established concepts, objectives, standards and conventions that have evolved over time to guide how financial statements are prepared and presented.

Generally Accepted Accounting Principles | Business Paper ... The term Generally Accepted Accounting Principles (GAAP) appears in 1935 when the AIA publishes Examinations of Financial Statements, which introduces it into public circulation (Zeff, 2016). In the 1940s, the process of public comment on the principles underlying the standards was gaining momentum.

US GAAP: Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP or US GAAP) are a collection of commonly-followed accounting rules and standards for financial reporting. The specifications of GAAP, which is the standard adopted by the U.S. Securities and Exchange Commission (SEC), include definitions of concepts and principles, as well as industry-specific rules.

80.20 - Generally Accepted Accounting Principles Generally accepted accounting principles (GAAP) are uniform minimum standards of and guidelines to financial accounting and reporting. GAAP establishes appropriate measurement and classification criteria for financial reporting.

GAAP - Generally Accepted Accounting Principles Generally Accepted Accounting Principles (GAAP) is a framework that chalks down rules, procedures, guidelines and best practices for financial accounting and reporting of business transactions. Generally Accepted Accounting Principles ensure consistency, transparency, objectivity, materiality, and full disclosure.

Wiley Regulatory Reporting: Wiley GAAP 2021: Interpretation and Application of Generally Accepted Accounting Principles (Paperback)

› accounting-principles-iAccounting Principles I - CliffsNotes CliffsNotes study guides are written by real teachers and professors, so no matter what you're studying, CliffsNotes can ease your homework headaches and help you score high on exams.

PDF The Hierarchy of Generally Accepted Accounting Principles ... 1. The objective of this Statement is to identify the sources of accounting principles and the framework for selecting the principles used in the preparation of general purpose financial reports of federal reporting entities3 that are presented in conformity with generally accepted accounting principles (the GAAP hierarchy). a.

Generally Accepted Accounting Principles Research Papers ... Accounting Finance, Generally Accepted Accounting Principles Strategic design of robust global supply chains: two case studies from the paper industry To remain competitive in today's competitive global economy, corporations must constantly improve their global logistics strategy, modify their supply chain configuration, and update ...

What are Generally Accepted Accounting Principles (GAAP ... That's where Generally Accepted Accounting Principles (GAAP) come in. GAAP represents methods, rules and practices that provide guidelines and procedures—as well as objective standards—for financial data and statements. In short: GAAP standardizes accounting for all companies, so the data they're reporting is universally understood and ...

0 Response to "43 generally accepted accounting principles"

Post a Comment